How-to: Managing Work in Progress (WIP)

Introduction

Work In Progress (WIP) is generally defined as the working stock of a project-based organization and it can include:

- hours

- hours of third parties (for example, when projects are outsourced)

- used materials, and

- cost of third parties (direct cost).

In general, the purpose of WIP is to handle the key accounting issue of allocating revenue and cost to different accounting periods, within which the contract work is performed. You can define the default WIP method of a project at WIP method in the WIP method section of Project settings. For more information, see Creating and maintaining projects and Project settings.

In the administrative structure, WIP is based upon the Realization and Prudence principles of accounting. The Realization principle indicates that cost and revenue which are directly related to each other should be registered on the profit and loss statement within the same financial reporting period. On the other hand, the Prudence principle indicates that we should register the cost, when known or may be suspected, and the revenue, when realized. Due to the diversity of project-based organizations, every organization handles WIP differently. However, the different ways of handling WIP are still based on the international regulations for accounting WIP as stipulated in the International Accounting Standards (IAS) 11 (11.22 and 11.32). This document discusses the following types of WIP methods based on a standard sales order:

- Percentage of completion cost recognition (PoCCR)

- Percentage of completion cost recognition (budget) (PoCCR budget)

- Percentage of completion revenue recognition (PoCRR)

- Percentage of completion revenue recognition (budget) (PoCRR budget)

- Completed contract method (CC)

- To be invoiced (TBI)

- Cost of sales method (COS)

- No : WIP

Long term projects can be classified as the following:

- Internal projects or projects that are executed by the company's own account:

For these projects, you need to book the profits from the projects in the year which the goods/services resulted from the projects were sold.

- Projects that are requested by a third party:

For these projects, there are two methods to determine when to book the profits:

- Percentage of completion — Profit is recorded proportionally based on the percentage of completion or realization of the project.

- Completed contract — Profit is recorded upon the completion of the project.

Based on the To be invoiced method, WIP represents the outstanding billable amount to the customer. It provides an overview of the amount that has yet to be invoiced. This method enables the booking of WIP whenever there is a change of price, for example, when discounts are offered or a higher price for items in a project is charged.

As for the Cost of sales method, recognized cost is used in the calculation of WIP. The choice for either one of these methods will depend on the type of projects. For similar type of projects, you need to use the same method for booking the profits. According to the International Financing and Reporting Standards (IFRS), the use of the percentage of completion method to account for WIP is recommended unless it is impossible to measure the progress of a project. In such case, you can use other WIP methods. Meanwhile, the valuation of WIP can be based on cost price and revenue.

Finally, there are two possibilities to account for WIP:

- Result method — With this method, you can directly book all cost and revenue realizations on a profit & loss general ledger account and determine WIP at a later stage.

- Work in progress method — With this method, you can directly book realizations on the WIP general ledger account on the balance sheet and release this at a later stage to the profit & loss statement.

Description

Percentage of completion cost recognition (PoCCR)

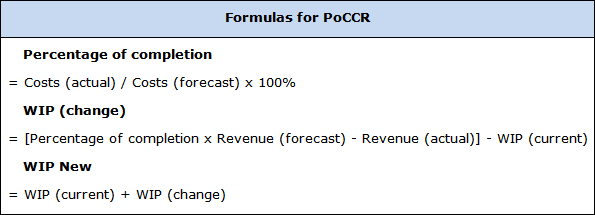

If a project is executed by the order of third parties, the profit can be determined by the percentage of completion method, whereby profit is taken proportionally with the realizations of the work or project. In order to account for WIP for several projects in a specific period and determine the change of WIP, you have to determine the percentage of completion based on the forecast and actual or realized cost. This method is used for projects that are active over many financial report periods. Based on the actual and forecast costs, a percentage of completion is calculated.

Percentage of completion cost recognition (Budget) (PoCCR budget)

Similar to PoCCR, the profit can be determined by the percentage of completion method, whereby profit is taken proportionally with the realizations of the work or project. However, as WIP calculations are based on planning, you have to adhere strictly to dates. Therefore, you can use PoCCR budget instead of PoCCR, whereby the calculations are based on total budget versus realization, and the budget does not depend on a date. It is also used for projects that are active over many financial report periods. PoCCR budget is available only if you have the SE1050-E-Budget module in your license.

Percentage of completion revenue recognition (PoCRR)

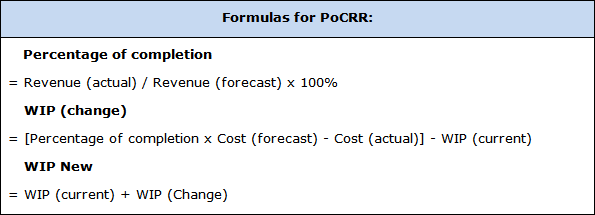

This method is similar to PoCCR, but the percentage of completion is based on the forecast and actual or realized revenue instead of cost.

Percentage of completion revenue recognition (budget) (PoCRR budget)

The method is very much similar to PoCCR budget, but the percentage of completion is based on the forecast and actual or realized revenue instead of cost. This method is available only if you have the SE1050-E-Budget module in your license.

Completed contract (CC)

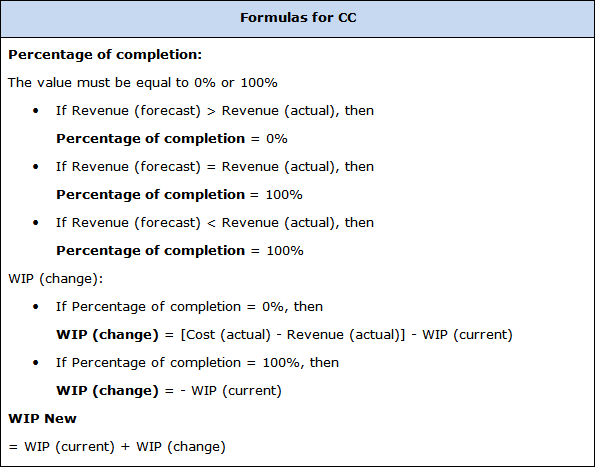

Besides the WIP methods discussed earlier, you can also calculate WIP using the Completed Contract (CC) method, if a project is executed by the order of third parties. With this method, profit is taken at the completion of the work or project. This method is also known as the zero profit method. In order to account for WIP for several of these projects in a specific period, the revenue should be recognized to the extent of recoverable expenses. The outcome of some projects cannot be estimated reliably except for the fact that the overall project is expected to be profitable. As long as the project is not completed, no profit or loss is taken in the financial results. After generating the WIP, the result for the project on profit & loss statement should be zero. When the project is finished, the WIP or project result is released. The forecast is not used for the WIP calculation. Only the proposed percentage of completion is based on the actual and forecast.

To be Invoiced (TBI)

This method enables the booking of WIP whenever there is a change of price, for example, when discounts are offered or a higher price for an hour item is charged. The new WIP entry will represent the outstanding billable amount to the customer. It can also provide an overview of the amount that has yet to be invoiced. The calculation is based on realized hours that are authorized but not yet invoiced multiplied by a sales rate. The forecast and percentage of completion are not used in this method, while rates used are based on the project rate structure.

Cost of Sales (COS)

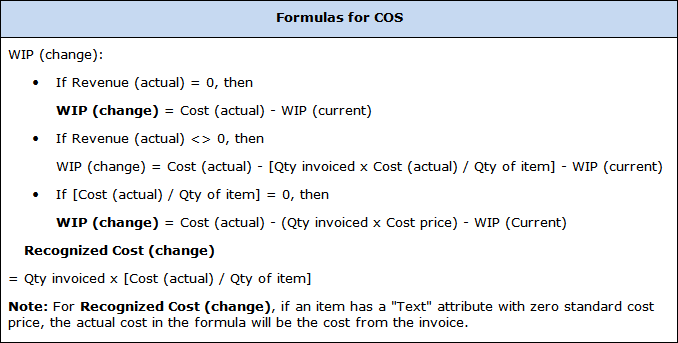

The recognized cost function will be applicable when you select the Cost of sales (COS) as the WIP method to be used. Recognized cost is calculated based on the invoiced quantities multiplied by the average purchase price of the item. The percentage of completion is not applicable for this method. By using this WIP method, a proposal for recognized cost can be generated at Projects ➔ Projects ➔ Work in progress. For more information, see Generating overview of Work in Progress of projects. In general, there are three conditions that need to be met before the recognized cost application can be used and calculated. These conditions are:

- WIP method is set to COS method.

- Sales order is fulfilled.

- Sales invoice is processed.

If the COS method is available for selection at WIP method in the Basics tab of a project maintenance card, you will see the Suggestion (Recognized costs) check box at Proposal in Projects ➔ Projects ➔ Work in progress. For more information, see Creating and maintaining projects and Generating overview of Work in Progress of projects. Select this check box to show the suggested recognized cost in the WIP overview. The revenue and the recognized cost accounts are defined at Revenue account and Cost of goods sold account, respectively in the Basics tab of the item group maintenance screen. For more information, see Creating and maintaining item groups. The WIP method field is available in the license for all countries except the Netherlands. When you generate the WIP entry for recognized cost, the recognized cost GL account of the item group, which the item is linked to, will be used. You must link the hour item to the item group to use the recognized cost GL account. To link an hour item to a specific item group, select an item group at Item group in the Financial tab of the hour item maintenance screen. The respective accounts of the item group will be automatically filled in at the Revenue, Salary payment, and Realizations fields.

No : WIP

It is also possible not to link the project to any WIP method. Select No : WIP if you do not want to link the project to any WIP method. As a result, the corresponding project will be available for selection at the Project field at Projects ➔ Projects ➔ Work in progress and the Work in progress button at the bottom of the corresponding project maintenance screen is disabled. For more information, see Generating overview of Work in Progress of projects and Creating and maintaining projects.

Related documents

| Main Category: |

Attachments & notes |

Document Type: |

Online help main |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

18.885.646 |

| Assortment: |

Exact Globe+

|

Date: |

26-09-2022 |

| Release: |

|

Attachment: |

|

| Disclaimer |