PU 423|422|421 (Globe) and 500|422|421 (Globe+): Export to include VAT numbers in Intrastat return (Spanish legislation)

To comply with the latest Intrastat structure provided by the Spanish Tax Agency, it is mandatory to include the partner's VAT number for all export declarations starting from year 2022 and onwards.

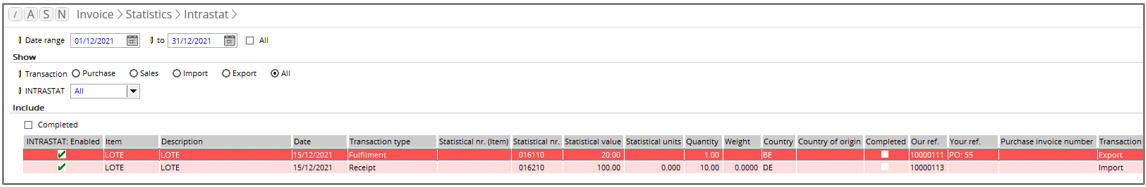

The VAT numbers are included in the Intrastat file for the

export flow or dispatch transactions (generated through Invoice >

Statistics > Intrastat). You can also find the VAT number in the Ordered

by or Ordered at information in sales and purchase orders. Note that

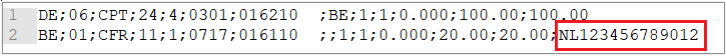

you can only enter up to 14 characters for the VAT number and any extra

characters will be truncated.

Check debtor and creditor VAT numbers

Ensure that the VAT number in the debtor and creditor

maintenance cards are valid before you submit the Intrastat return. The first

two letters of the VAT number must contain the country code followed by the VAT

number. If the first two characters provided are not letters, the debtor or

creditor country code will be prefixed to the VAT number.

The following is a sample of the VAT number shown in the

Intrastat file:

For more information, see https://sede.agenciatributaria.gob.es/Sede/en_gb/aduanas/intrastat-obligaciones-estadisticas/noticias-interes/nota-intrastat-partir-ano-2022.html.

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

30.478.981 |

| Assortment: |

Exact Globe

|

Date: |

20-05-2022 |

| Release: |

|

Attachment: |

|

| Disclaimer |