Menu path

Introduction

More contries are supported with Non-deductible VAT which can be seen in RN 05.503.483 - Batch 325: Non-deductible VAT added for more countries.

There are several changes done on this functionality within this period (325 until now). Please see explanation below for more details.

* Non-deductible VAT can only work in Purchase journal + Single TAX environment

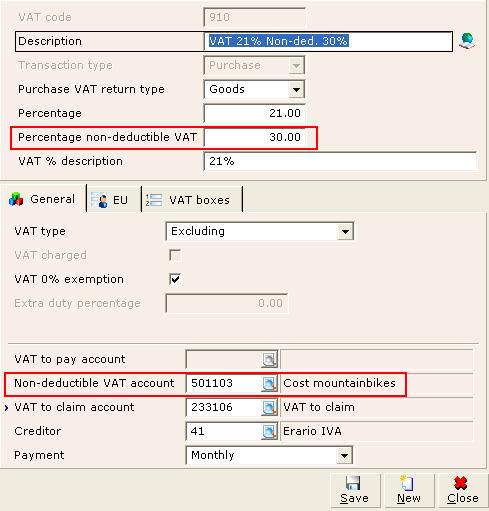

Settings for Non-deductible VAT

Percentage % for Non-deductible VAT can be defined through the maintenance of the VAT code and not only the General ledger (Cost) account:

-

Percentage non-deductible VAT - To set the % for Non-deductible VAT (same as Non-ded. VAT in the General ledger (Cost) account).

-

Non-deductible VAT account - To define a Non-deductible VAT account (same as Non-ded. VAT account in the General ledger (Cost) account).

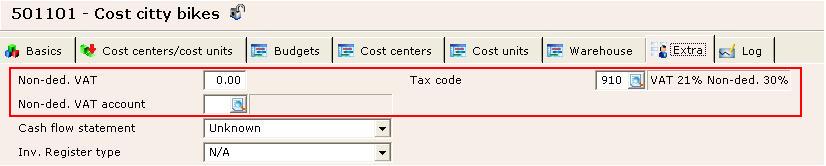

The Non-deductible VAT code can be linked to the General ledger (Cost) account without having to define the Non-ded. VAT and also Non-ded. VAT account in the General ledger (Cost) account:

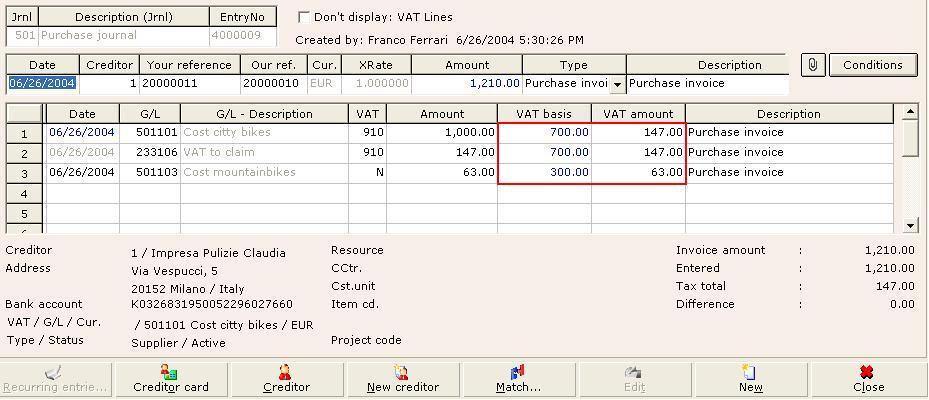

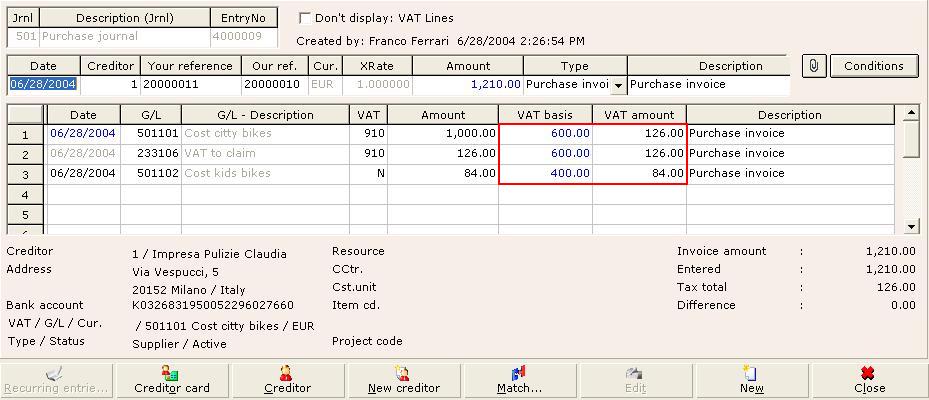

VAT basis and VAT amount in Purchase journal

The following lines are created when entering the purchase invoice and link to the above Non-deductible VAT code:

The display for VAT basis and VAT amount is different from RN 05.503.483 - Batch 325: Non-deductible VAT added for more countries.

Now VAT basis is divided into taxable amount 700 EUR (1000 * 0.7) and non-deductible amount 300 EUR (1000 * 0.3). VAT amount is equal to 210 EUR (1000 * 0.21). Out of this 210 EUR, 147 EUR (210 * 0.7 or 700 * 0.21) is taxable VAT amount and 63 EUR (210 * 0.3 or 300 * 0.21) is non-deductible VAT amount.

Priority: Non-deductible General ledger (Cost) account or VAT code with Non-deductible VAT?

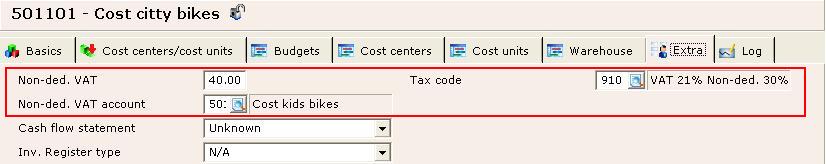

There has been a question on 'How should Non-deductible VAT be calculated if an entry is using a Non-deductible General ledger (Cost) account and a Tax code with Non-deductible VAT?'. Meaning the setting for Non-ded. VAT, Non-ded. VAT account and Tax code are filled in the General ledger (Cost) account:

Answer is the priority will be given to Non-deductible General ledger (Cost) account:

Despite the VAT code 910 set in the General ledger (Cost) account, the calculation for Non-deductible VAT will be based on Non-ded. VAT (40% instead of 30%) and Non-ded. VAT account (501102 instead of 501103) if there is any.

Hence VAT basis is divided into taxable amount 600 EUR (1000 * 0.6) and non-deductible amount 400 EUR (1000 * 0.4). VAT amount is equal to 210 EUR (1000 * 0.21). Out of this 210 EUR, 126 EUR (210 * 0.6 or 600 * 0.21) is taxable VAT amount and 84 EUR (210 * 0.4 or 400 * 0.21) is non-deductible VAT amount.

Note: If Non-deductible VAT account is not defined, the same General ledger (Cost) account will be used meaning 501101 in this case.

Different legislations - How entry lines should be created

100% Non-deductible

1. Spain (with VAT 16% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 60000000, 15, 1,000.00, 0.00, 0.00

19/11/2004, 47200000, 15, 0.00, 0.00, 0.00

19/11/2004, 600001, N, 160.00, 1,000.00, 160.00

2. Italy (with VAT 20% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 502205, 920, 200.00, 200.00, 40.00

19/11/2004, 233106, 920, 0.00, 0.00, 0.00

19/11/2004, 502205, N, 40.00, 200.00, 40.00

3 . Belgium / Luxembourg (with VAT 21% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 610000, 5, 82.64, 82.64, 0.00

19/11/2004, 411000, 5, 0.00, 82.64, 0.00

19/11/2004, 610000, N, 17.36, 82.64, 17.36

70% Non-deductible

1. Spain (with VAT 16% incl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 600000, 3, 86.21, 25.86, 4.14

19/11/2004, 472004, 3, 4.14, 25.86, 4.14

19/11/2004, 600000, N, 9.66, 60.35, 9.66

2. Italy (with VAT 20% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 502205, 920, 100.00, 100.00, 20.00

19/11/2004, 233106, 920, 6.00, 30.00, 6.00

19/11/2004, 502205, N, 14.00, 70.00, 14.00

3. Belgium / Luxembourg (with VAT 21% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 610000, 5, 100.00, 100.00, 6.30

19/11/2004, 411000, 5, 6.30, 100.00, 6.30

19/11/2004, 610000, N, 14.70, 14.70, 0.00

VAT charged

1. Belgium / Luxembourg / France (with VAT 21% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 610000, B5, 100.00, 100.00, 0.00

19/11/2004, 411000, B5, 21.00, 100.00, 21.00

19/11/2004, 451000, B5, -21.00, 0.00, -21.00

2. Normal (with VAT 21% excl.)

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 7000, B5, 100.00, 100.00, 0.00

19/11/2004, 1511, B5, 21.00, 100.00, 21.00

19/11/2004, 1502, B5, -21.00, -100.00, -21.00

70% Non-deductible + VAT charged

1. Belgium / Luxembourg / France

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 610000, B5 100.00, 100.00, 0.00

19/11/2004, 411000, B5, 6.30, 100.00, 6.30

19/11/2004, 610000, N, 14.70, 14.70, 0.00

19/11/2004, 451000, B5, -21.00, 0.00, -21,00

100% Non-deductible + VAT charged

1. Belgium / Luxembourg / France

Date, G/L, Description, VAT, Amount, VAT basis, VAT amount

19/11/2004, 610000, B5 100.00, 100.00, 0.00

19/11/2004, 411000, B5, 0.00, 100.00, 0.00

19/11/2004, 610000, N, 21.00, 21.00, 21.00

19/11/2004, 451000, B5, -21.00, 0.00, -21,00

|

|