Product Updates 419, 418, and 417: VAT number for self-employed entities available (Dutch legislation)

The companies in the Netherlands have two types of the

VAT-related numbers. The VAT identification number, which is also the OB number

with the "NL" prefix, is specifically used for communication between

their business partners, and the VAT number, which is the number without the

"NL" prefix, is used only for communication with the tax office.

Previously, the social security number of the self-employed

entities was used as the VAT number. With the introduction of the GDPR

regulations, and to protect the personal information of the self-employed

entities, the Dutch tax office has replaced the VAT identification number with

a new number that cannot be derived from the OB number. The existing OB Number remains

unchanged.

The self-employed and other legal entities will now be able

to define the VAT identification number and OB number at two different fields

in Exact Globe Next. Additionally, the validation process for both fields is

different whereby the VAT number field will first be validated by the

Elf Proof algorithm, and upon unsuccessful validation, will then be validated

by the Modulus 97 algorithm. The OB number field will be validated by

the Elf Proof algorithm.

Thus, for the self-employed entities, it is required to redefine the VAT number upon receiving the new VAT identification number from the tax office. For the other legal entities, it is not necessary to redefine the VAT-related number as the system will duplicate the VAT number as the OB number since there will be no new VAT identification number provided by the tax office.

The enhancements are as follows:

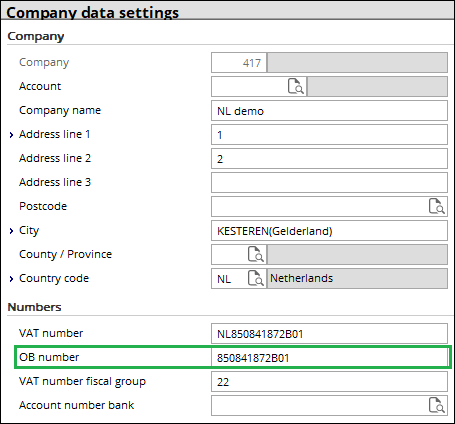

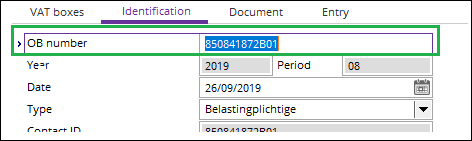

OB number in Company data settings

The OB number field has been added in Company data

settings (accessible via System ➔

General ➔ Settings),

under the Numbers section.

Note: From this product update onwards, the VAT

number and OB number fields will be made mandatory when the Disable

VAT option under the VAT section is disabled in General ledger

settings (accessible via System ➔

General ➔ Settings).

Value for the OB number field

The supported value format of the OB number field is “XXXXXXXXXBXX”.

The following outcomes will be applicable when defining the value at the OB

number field:

- the NL prefix will be removed after the validation process. For

example, when defining the field with “NL010000446B01”, the value will be

changed to “010000446B01” after the validation process.

- When defining the field with a value that is not accepted by the

Elf Proof algorithm, and the characters are more or less than 12 characters,

the message “A Dutch VAT number consists of 14 characters” will be displayed.

- When defining the field with a value that is not accepted by the

Elf Proof algorithm, the message “The following value is invalid: VAT number”

will be displayed.

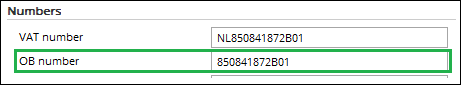

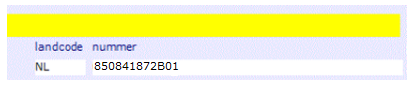

Updating database

When updating the database, the system will automatically

duplicate the existing value of the VAT number field in Company Data

settings to the OB number field, without the NL prefix, as displayed

in the following:

Note: Since the validation process for both fields is

different, the value that will be duplicated may be invalid. It is necessary to

change the duplicated value to the correct value that will be accepted by the

Elf Proof algorithm.

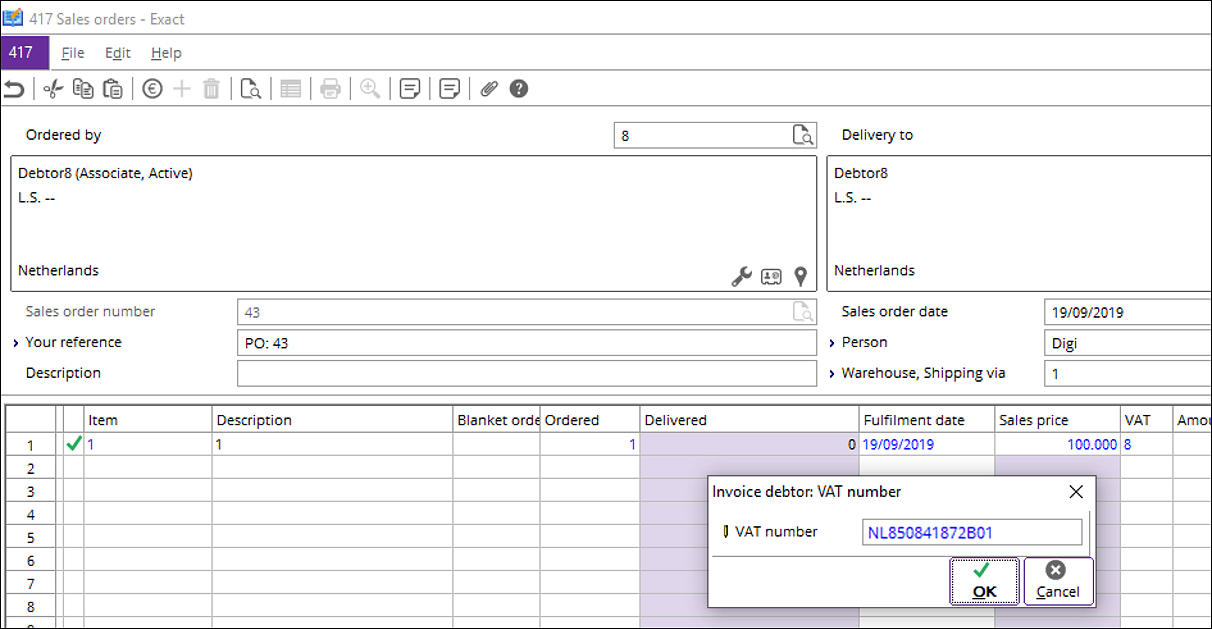

VAT number for financial and logistic journal entries

The VAT number screen will be displayed when an

account does not have the VAT number, and the VAT code that is used is of a

listing type. This is applicable to the sales, purchase, bank or cash journal entries

for the financial transactions, and to the sales orders and sales invoices for

the logistic transactions. The VAT number field in the screen supports

the Modulus 97 value along with the existing Elf Proof value.

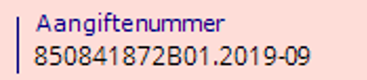

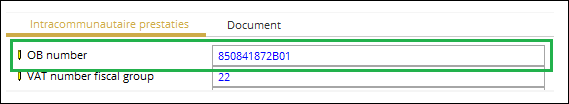

OB number in VAT return, corrections, and ICP return submission

The OB number will be displayed in the traditional and

electronic reports of the VAT return, VAT return correction, and EU sales list

in place of the VAT number.

VAT return

EU sales list

The following are samples of the electronic reports of the

VAT return and EU sales list with the displayed OB number:

VAT return/VAT return correction\

EU sales list

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.174.972 |

| Assortment: |

Exact Globe

|

Date: |

09-10-2019 |

| Release: |

|

Attachment: |

|

| Disclaimer |