Product Updates 417, 416 and 415: Enhancements introduced to support online submission of VAT returns (British legislation)

Since April 2010, all UK businesses have had to submit their VAT returns online and to

support our customers, we introduced the online support of VAT returns. For more information, see Online VAT returns supported.

Taking this one stage further, the Making Tax Digital for business will begin on April 1, 2019. This is an initiative by

the HM Revenue and Customs (HMRC) to ensure the UK tax system is effective, efficient, and easier for the taxpayers. From that date onwards, all VAT-registered

businesses above the threshold of £85,000.00 will have to keep digital records and submit VAT returns using compatible software.

Due to this initiative, enhancements have been introduced to continue to support the online submission of VAT

returns to the system by HMRC.

Enhancements to the XML file

The value of some of the elements has been changed and additional prefixes have been added to the XML file. These changes

ensure that the submission of VAT returns can be done online.

Change to default setting

One of the major MTD changes has been to

the URL used for the Government Gateway. Therefore, the current default URL has

been changed to reflect the new URL, which is:

- https://transaction-engine.tax.service.gov.uk/submission

Once the settings and environment have been set up as explained in Online

VAT returns supported, the XML files will be generated simultaneously with the VAT returns report during the processing of VAT returns.

Assigning VAT return periods

If you have set up the feature to generate

XML files for VAT returns, you need to ensure that the VAT return periods are

assigned to entries at Finance ? VAT / Statistics ? VAT overview in the “YYYY-MM” format. For example, “2018-11” is

assigned for the return period of November 2018. Even if you have completed a quarterly return, the expected format is still “YYYY-MM” with the month being

the last month of the quarter. An error message will be displayed during the VAT processing if the return period does not conform to the format. You can

continue the processing once the return period is reassigned using the required format.

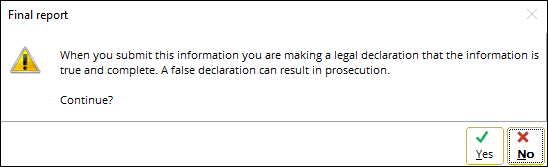

Confirmation message introduced when submitting VAT returns

When clicking Send to submit the VAT return in the

final form, a message will now be displayed to confirm the submission:

Once you clicked Yes, a message will be displayed to indicate the success of the submission.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

28.672.617 |

| Assortment: |

Exact Globe

|

Date: |

15-01-2019 |

| Release: |

415 |

Attachment: |

|

| Disclaimer |