Product Updates 414, 413, and 412: Payer types and grouping option for withholding tax enhanced (Thai legislation)

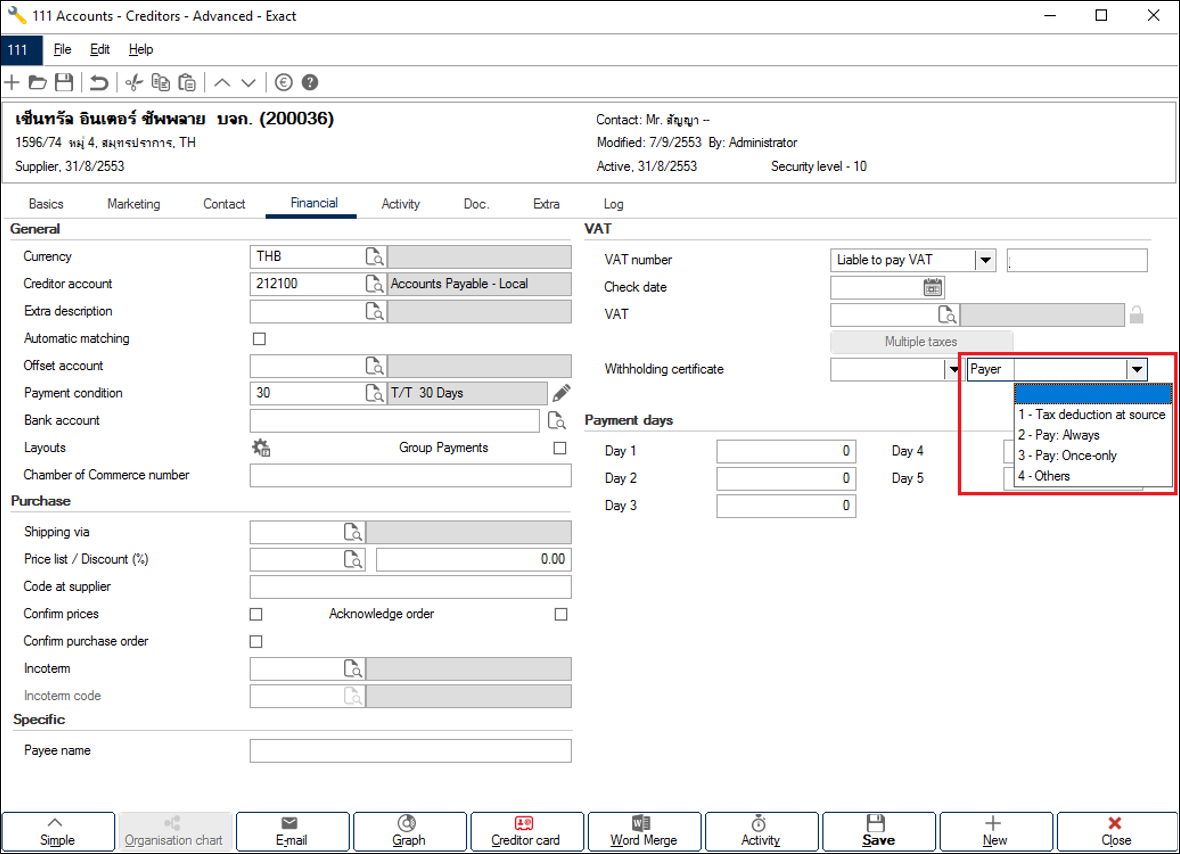

Four payer types are now available for selection in the Accounts

Payable maintenance screen. Once selected, the payer type will be reflected

in the generated withholding tax certificates and reports. Previously, the Type

1 – withhold at source payer type was the default value and could not be

changed.

Furthermore, tax reports for a supplier using two tax

percentages (for example, 3% for service and 5% for rental) can now be grouped

in multiple sections or a single section.

This enhancement is applicable to the withholding tax

certificates and reports in the English and Thai languages, and also for the Trial

and Final prints.

Selection of payer type for withholding tax certificates and reports

The payer type can be selected via Finance à Accounts payable à Maintain. In the overview, select one of the creditors, and

click Open. The following screen will be displayed:

The payer types available for selection are explained in the

following table, whereas the calculations for the examples are provided under Calculations

that follows:

|

Payer type

|

Description

|

Example

|

|

1 – Tax deduction at source

|

The company withholds and deducts the tax from the payment made by

the supplier. The company will then pay the withholding tax to the Revenue

Department on behalf of the supplier.

|

An invoice with the amount of 1,000 Baht has been issued to the

company by the supplier. The company pays 970 Baht to the supplier, and 30

Baht, which has been deducted from the invoice amount, to the Revenue

Department.

|

|

2 – Pay: Always

|

The company bears the withholding tax and no deduction will be made.

|

An invoice with the amount of 1,000 Baht has been issued to the

company by the supplier. The company pays 1,000 Baht to the supplier, and

30.90 Baht to the Revenue Department1.

|

|

3 – Pay: Once-only

|

The company bears the withholding tax for the supplier but only for one

time. The supplier has to pay a partial amount.

|

An invoice with the amount of 1,000 Baht has been issued to the

company by the supplier. The company pays 999.07 Baht to the supplier, and 30 Baht

to the Revenue Department for one time. The supplier bears the partial amount of 0.93 Baht. In total, 30.93 Baht is paid to the Revenue Department2.

|

|

4 – Others

|

None of the above.

|

N/A

|

Calculations:

1 Pay for service * Withholding tax % / (100 –

Withholding tax %)

2 (Pay for service + Withholding tax amount) *

Withholding tax %

Note: The withholding tax calculations for the payer types will be handled manually by users during the entry application. Exact Globe Next only retrieves the selected payer type from the Accounts Payable maintenance screen, and generates the information into the withholding tax certificates and reports.

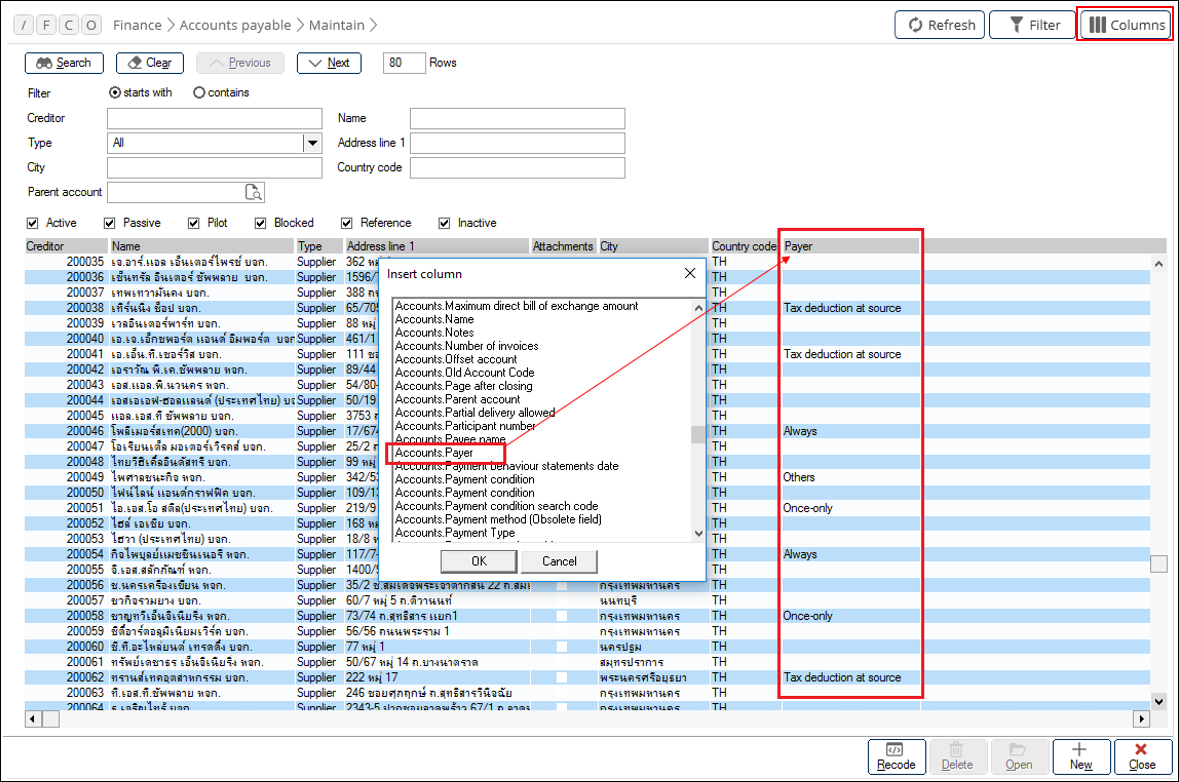

To display the payer type in the Accounts Payable maintenance

overview screen, click Columns and select Accounts.Payer in the Insert

column screen. The selected payer type is displayed as follows:

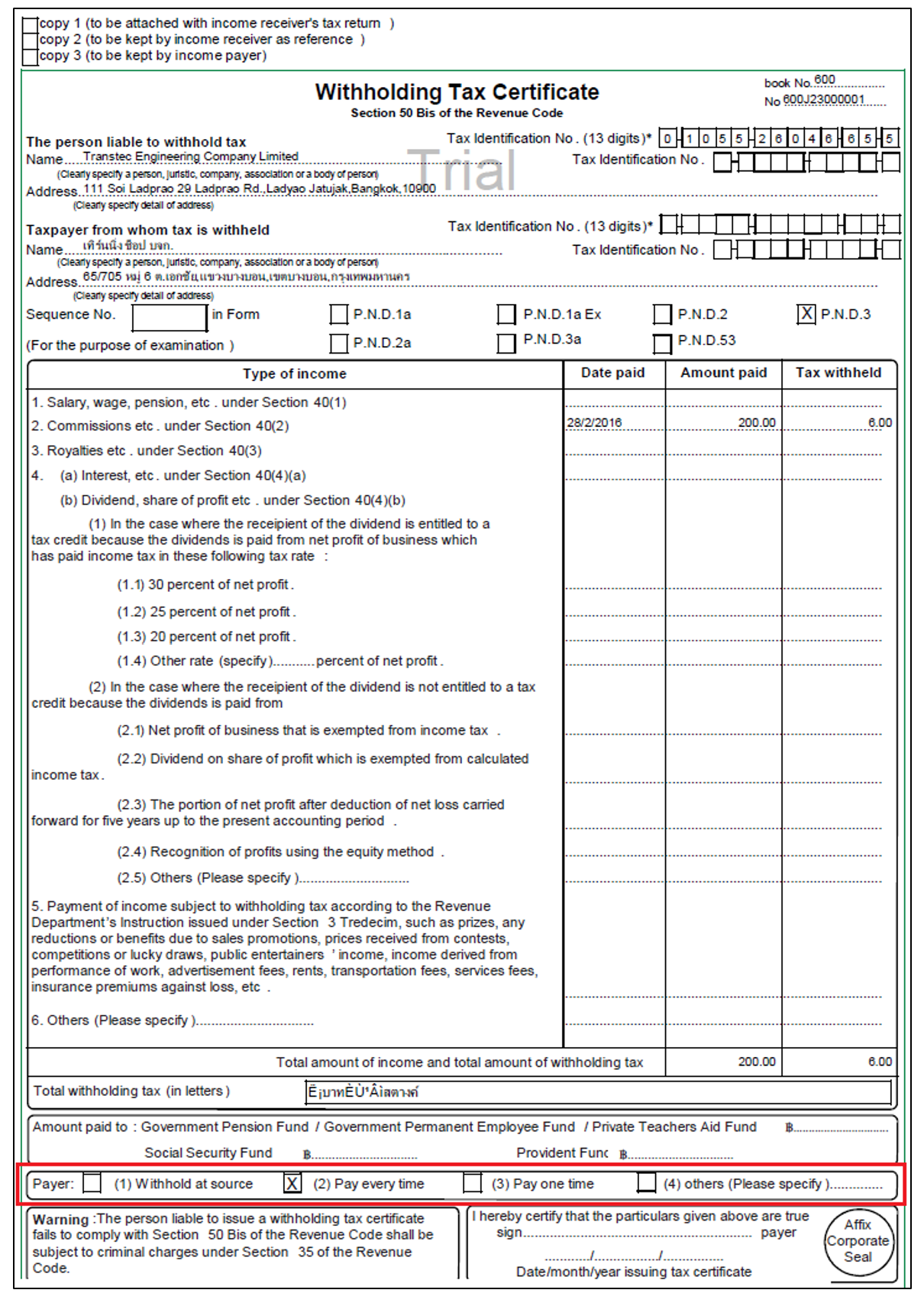

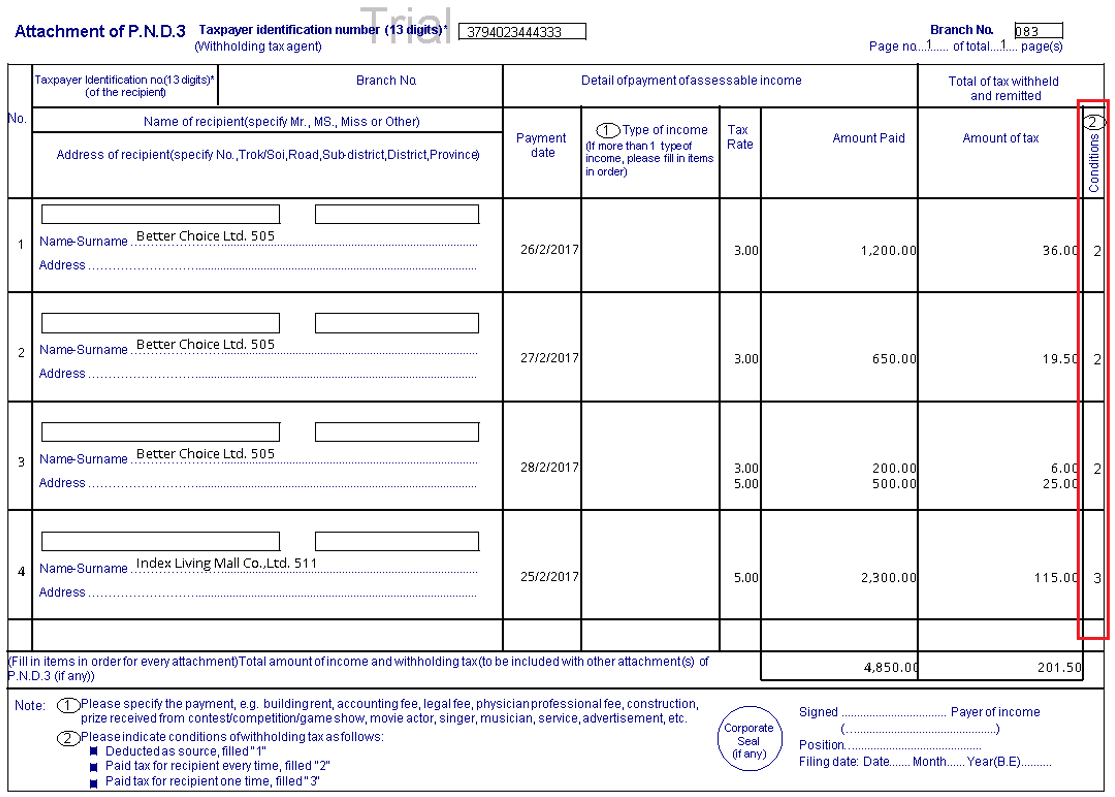

In the withholding tax certificate, the

selected payer type is displayed under the Payer section and in the

withholding tax report, this is displayed in the Conditions column. See

the following samples:

Note: You

are required to change the payer type for existing creditors if the creditors

are not of the Type 1 – withhold at source payer type. This has to be done manually.

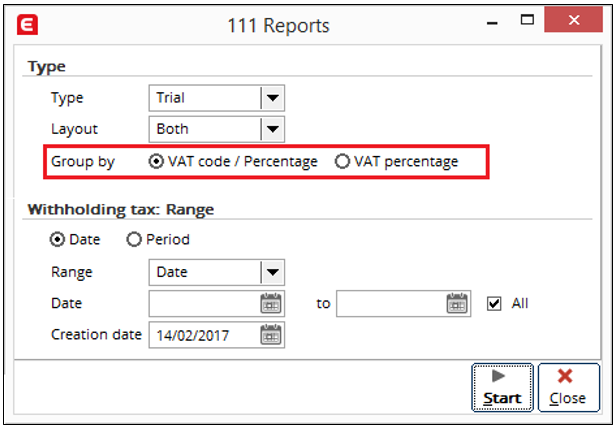

Grouping option in the withholding tax reports

In the Reports screen, Group by has been added

with the options VAT code / Percentage and VAT percentage. You

can select either option to group the withholding tax reports accordingly. By

default, VAT code / Percentage is selected.

The options are explained in the following:

- VAT code / Percentage: When selected, the withholding tax

reports are grouped by Supplier, per Payment, Payment date,

Tax code, and Tax percentage in multiple sections. (as existing)

- VAT percentage: When selected, the withholding tax reports

are grouped by Supplier, per Payment, Payment date, and Tax

percentage in a single section.

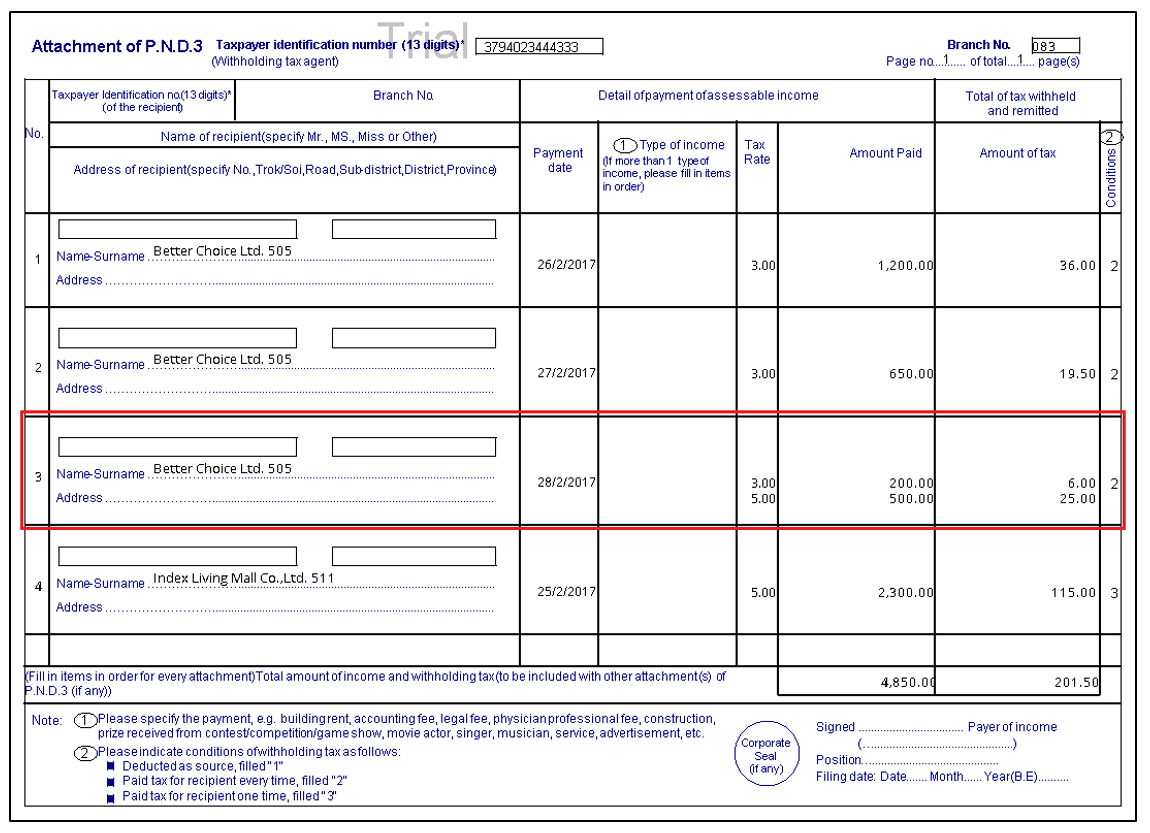

The following sample displays how the tax reports are

grouped when VAT code / Percentage is selected:

The following sample displays how the tax reports are

grouped when VAT Percentage is selected:

For more information, see Product

Update 402: Withholding tax feature for Thailand enhanced (Thai legislation)

and Product

Update 405: Changes to withholding tax (Thai legislation).

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

27.552.926 |

| Assortment: |

Exact Globe

|

Date: |

10-03-2017 |

| Release: |

412 |

Attachment: |

|

| Disclaimer |