PU 423 (Globe) and 502 | 501 | 500 (Globe+): Changes to Spanish VAT return Modelo 303 for year 2023 (Spanish legislation)

The VAT return Modelo 303 is a tax return form that

companies use to collect the VAT from their buyers on behalf of the tax

authority for the sale of their products and services.

In

this product update, we made the following changes:

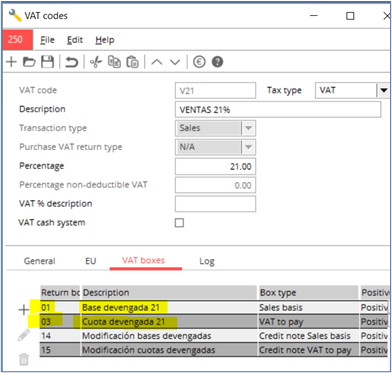

VAT boxes

In

the VAT maintenance box, we updated several of the VAT box descriptions.

|

Box

|

Previous

description

|

New

description

|

|

01

|

Base

devengada 21

|

Base

devengada 4

|

|

03

|

Cuota devengada 21

|

Cuota devengada 4

|

|

07

|

Base

devengada 4

|

Base

devengada 21

|

|

09

|

Cuota devengada 4

|

Cuota devengada 21

|

|

16

|

R.E.

Base 5,20

|

R.E.

Base 0/0,50/0,62

|

|

18

|

R.E. Cuota 5,20

|

R.E. Cuota

0/0,50/0,62

|

|

19

|

R.E.

Base 1,40

|

R.E.

Base 1,40

|

|

21

|

R.E. Cuota 1,40

|

R.E. Cuota 1,40

|

|

22

|

R.E.

Base 0,50

|

R.E.

Base 5,20

|

|

24

|

R.E. Cuota 0,50

|

R.E. Cuota 5,20

|

The following boxes are recoded:

|

Box

|

Description

|

|

150

|

Base

devengada 0

|

|

152

|

Cuota devengada 0

|

|

153

|

Base

devengada 5

|

|

155

|

Cuota devengada 5

|

|

156

|

R.E.

Base 1,75

|

|

158

|

R.E. Cuota 1,75

|

Note: The system will recode the boxes automatically. You do not have to unlink and relink the VAT boxes to the VAT codes. For example, once you run the product updater, the current VAT code that is linked to boxes 01/03 will become 07/09.

User interface

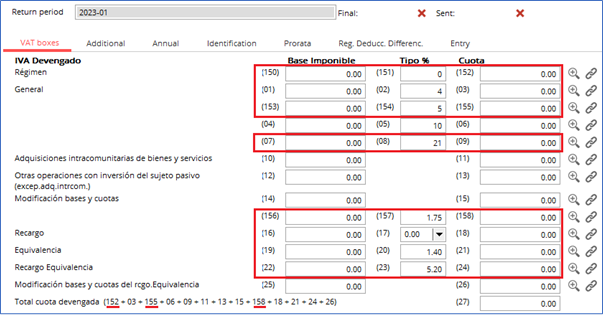

Due to the introduction of the 0% and 5% VAT percentages, we added the VAT boxes 150, 151, 152, 153, 154, and 155 in the user interface, as highlighted in the following image:

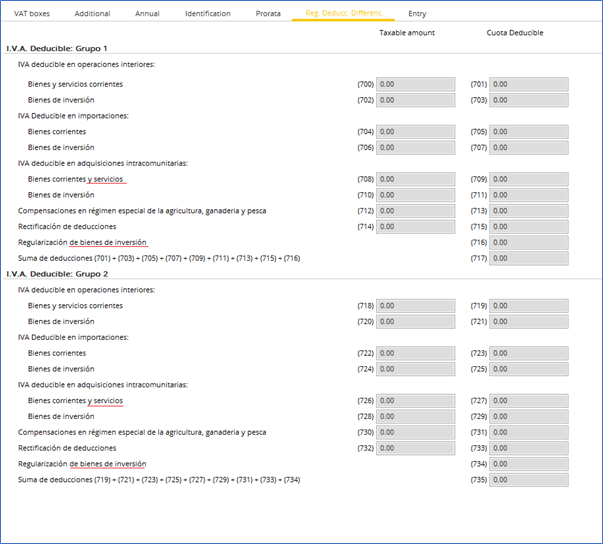

We also updated some of the descriptions in the Reg. Deducc. Differenc. tab.

We included some of the changes to the year 2023 text file, such as the following:We included some of the changes to the year 2023 text file, such as the following:

<T30302023010000><AUX>

P424

B46555363

</AUX><T30301000> UB46555363ESPANOL ESPANOL,

JUAN

202301223222222

20000000000000010000000000000000000000000000000000000010000004000000000000000040000000000000010000005000000000000000050000000000000000000010000000000000000000000000000000010000021000000000000000210000000000000000000000000000000000000000000000000000000000000000000000N0000000000002000N000000000000008000000000000000000001750000000000000000000000000000000000000000000000000000000000000000000000000001400000000000000000000000000000000000005200000000000000000000000000000000000000000000000000000000000000000292000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000002920

</T30301000><T30303000>0000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000029201000000000000000002920000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000000002920000000000000000000000000000000000000000000000002920

</T30303000><T303DID00>

ES0600810658170001068607

0

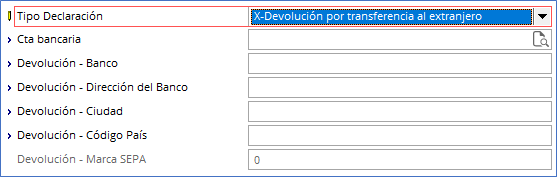

We added the “X-xxxxxx” option to the Tipo Declaracion

field for the foreign refund abroad. The following criteria determine which

fields will be visible to you:

- If

Tipo Declaration is “D” and Marca SEPA is “1” or Tipo Declaration is “V” and

Marca SEPA is “0”, you will not see the Bank name, Bank address, City,

and Country code fields in the VAT return tax file.

- If Tipo Declaration is “D” and Marca SEPA is

“2”, you will see the IBAN and SWIFT-BIC values in the tax file.

Please ensure that

you have selected the correct type for the invoice.

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

31.135.317 |

| Assortment: |

Exact Globe+

|

Date: |

10-03-2023 |

| Release: |

|

Attachment: |

|

| Disclaimer |