Product Updates 419, 418, and 417: Filtering option enhanced for Analytical accounting (Polish legislation)

You can now display the transactions by the tax date, and group them by the Our Ref / Tax date option.

This enhancement is applicable to the following

menu paths:

- Finance ➔ General ledger ➔ Analytical accounting

- Finance ➔ General ledger ➔ Select / Search

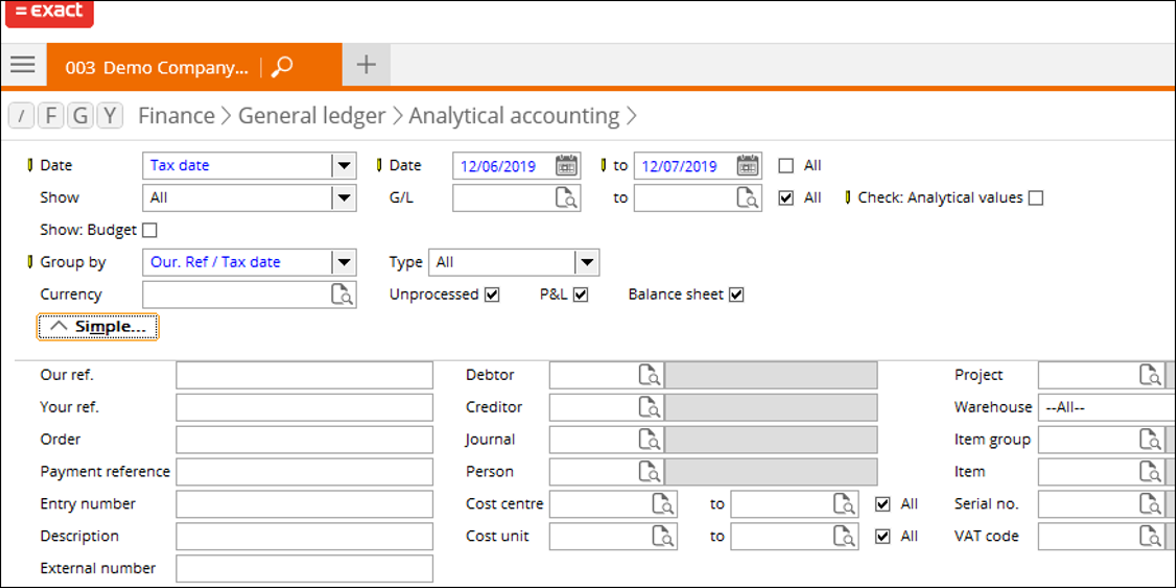

When displaying the transactions in the Analytical accounting overview screen, you can select the new filter options, namely Tax date, at the Date field, and Our. Ref/Tax date at the Group by field, as follows:

Analytical accounting overview screen

By selecting the Our. Ref / Tax date option, the transactions will be grouped by the our reference value or tax date. This option allows the grouping of the cash-based VAT transactions with the same our reference value but a different tax date.

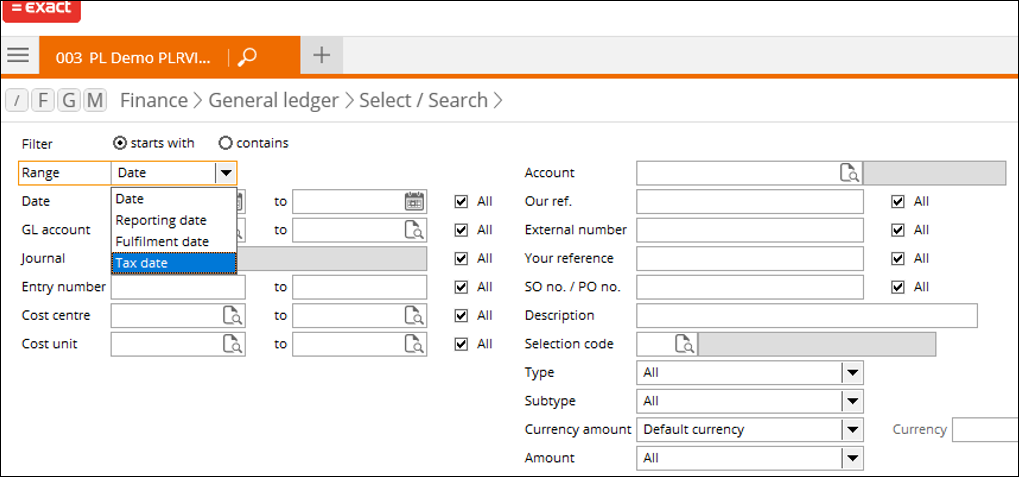

Select / Search overview screen

When displaying the transactions in the Select / Search overview screen, you can select the new filter option, namely Tax date, at the Date field, as follows:

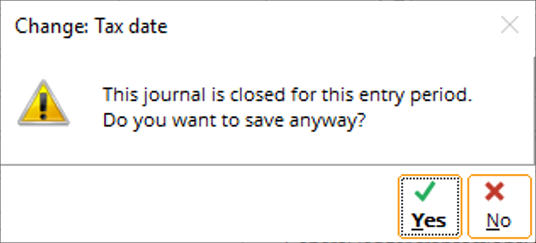

Changing tax date in the closed period

In addition to the new filter option, you

will now be prompted with a confirmation message when changing the tax date of

a transaction to a date that falls within a closed period. This is applicable

to the Manually, Tax date, and Apply journal setting

options via the Tax date button in the analytical accounting overview

screen.

When changing the tax date for multiple

transactions, the confirmation message will be displayed if any of the transactions

has a tax date that falls within a closed period. By clicking Yes, the

new tax date will then be applied to all of the selected transactions.

Tax date for cash-based VAT

The matching of the tax date is now supported for the cash-based VAT transactions. The tax date of the reversal entries will be based on the date of the payment terms. This is applicable to the sales and purchase transactions.

In the case multiple payments have been made, for example, from an invoice term to multiple payment terms, the tax date for each of the subsequent reversal entry will be based on the date of the corresponding payment term.

The update of the tax date will only be applied to the payment terms.

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.051.475 |

| Assortment: |

Exact Globe

|

Date: |

05-08-2019 |

| Release: |

|

Attachment: |

|

| Disclaimer |