Product Updates 407, 406, and 405: New requirements added to VAT from year 2014 onwards (Thai legislation)

In this product update, modifications have been done to some of the existing functionalities to comply with the VAT Notifications 194 – 197 by the Thai tax authorities. Information such as the head office, branch number, and tax identification number for both the debtors and creditors are required to be printed on the invoices and VAT reports, effective from 2014 onwards. For more information, see http://www.mazars.co.th/Home/Doing-Business-in-Thailand/Tax/New-VAT-Compliance-Rules-effective-2014.

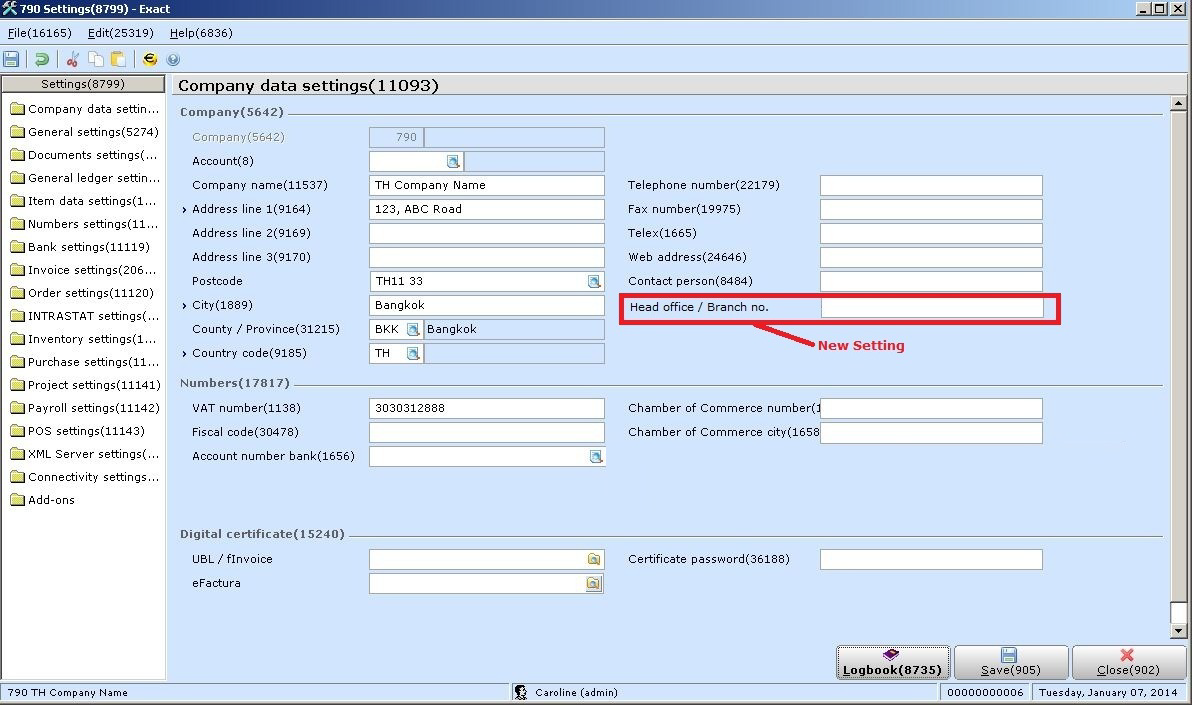

The tax identification number (or VAT number) has been one of the existing essential resources to the current VAT-related functionalities in Exact Globe Next. Hence, the information for the headquarters and branch accounts can be managed similarly to the VAT number. You can begin by defining the information for your own company headquarters or branch code under the Company section in the Company data settings screen at Systems à General à Settings. This information is optional, and stores up to 80 characters. For the VAT number, you can fill the information under the Numbers section in the same screen.

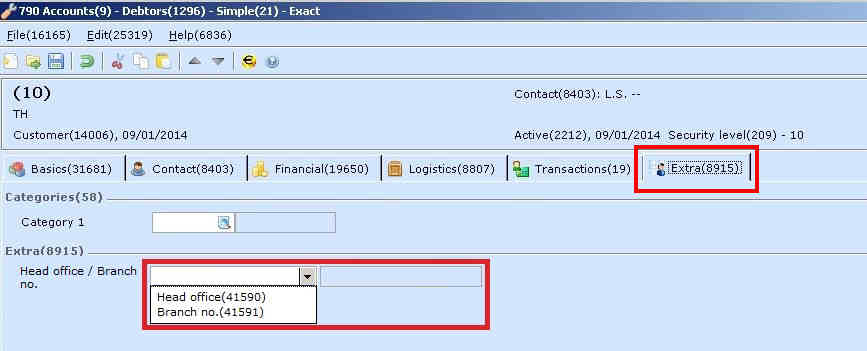

Next, go to Finance à Accounts payable à Maintain and Finance à Accounts receivable à Maintain. The Head office / Branch no. field is displayed under the Extra section in the Extra tab, as shown in the following example:

By default, the option Branch no. is selected at Head office / Branch no. and you must type the branch number or code for the debtors or creditors in the box next to the field. This box is disabled when you select the option Head office. The field and the options contain individual term IDs which can be used for translation purposes. VAT details can be filled under the VAT section in the Financial tab.

VAT report layouts

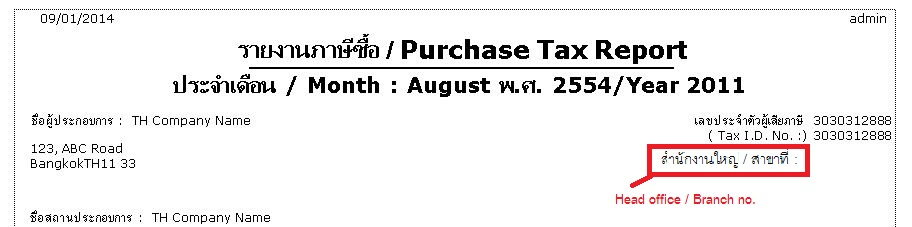

In light of these new compliance rules, the VAT report layouts (purchase and sales) have been restructured to reflect the new information. When you generate the VAT report from year 2014 onwards, the information for the company headquarters or branch office will be displayed below the VAT number in the header section, as shown in the following example:

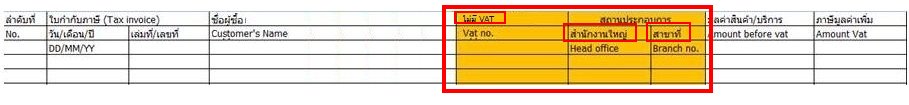

The VAT report layouts are accessible via Finance à VAT / Statistics à VAT reports. Also, two columns, namely Vat no. and the column for indicating the place of business, either the headquarters or the branch number have been added to the VAT report layouts for purchase and sales. The following is an example of the two columns on the sales VAT report layout:

Invoice, Direct invoice, Credit note, and Direct credit note layouts

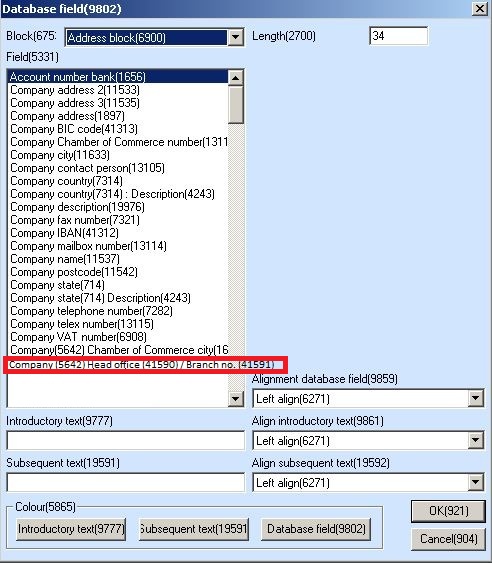

The Company Head office / Branch no. option has been added to the database field under the Address block for the invoice, direct invoice, credit note, and direct credit note layouts. You can access these layouts under the Logistics section in Documents settings via System à General à Settings.

For more information on how to customize document layouts, see Creating and maintaining layouts and Maintaining layouts: Inserting database fields.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

25.678.373 |

| Assortment: |

Exact Globe

|

Date: |

09-05-2017 |

| Release: |

405 |

Attachment: |

|

| Disclaimer |