Release 380: New Revaluation Method Per Invoice Group

Background

Background

The legislation of some countries requires that financial reports show the amount of Accounts receivable and Accounts payable revaluated according to the current official exchange rates. However, when receipt was collected from customer or payment was made to supplier, the actual exchange rate will be used and the rates were differed from the revaluation entries made from the original invoices. Therefore it is necessary to undo the revaluation entries manually based on the HISTORICAL exchange rates of the original invoices and rate of exchange rates of the payment/receipt entries.

For some countries, the manual adjustment on the revaluations entries required to create corresponding reversal entries, which was not applicable to create a reversal entry per invoice.

What has been changed

1. In release380, this new method of Revaluation Invoice by Group has been added .This functionality is available for all countries listed below:

-

Poland

-

France

-

Malaysia

-

Singapore

-

The Netherlands

-

Germany

-

Philippines

-

China

-

Thailand

-

Belgium

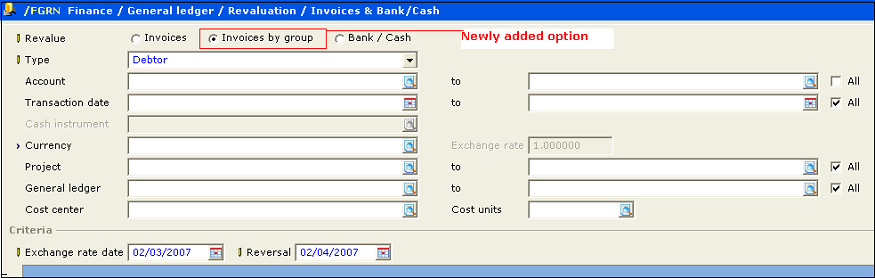

2. A new option, Invoice by Group is added.

The explanation of the newly added option as follows:

| Field on the screen |

Type of field |

Description |

Default |

Validations |

| Revalue |

|

Revaluation method selection |

Last used value |

Added new Invoices by Group option for revaluation per lump sum basis. |

| Type (New) |

Read Only |

Let user indicate Debtors or Creditors |

Last Used value |

Only Debtor or Creditors |

| Account (New) |

Mandatory |

User can select one account or a range of accounts to revalue |

All |

based on the Type Selected |

|

Exchange rate date |

Mandatory |

Revaluation date |

Last entered date |

Validate if the period of the entered date is not closed |

| Reversal date (New) |

Mandatory |

Reversal date |

1st Working day in next period |

|

3. Revaluation per invoice is not recommended. The function of revaluation per invoice remains unchanged. Revaluation results generated by per invoice method will be taken into consideration when performing revaluation of by Invoices by group.

4. Revaluation entry created based on all outstanding invoices where the invoice date is on or before the revaluation date entered per general ledger account (GL) per Debtor or Creditor per Currency. This includes the outstanding amount for partially paid invoices. Any unmatched payments or receipts allocated to the accounts will also be taken into consideration.

5. Revaluation must be done on a lump sum basis per GL per Debtor or Creditor per Currency.

6. Revaluation per Cost center (CC), Cost Unit (CU) or Project is optional.

7. The reversal entries are created in the General Journal specific by the user during processing of the revaluation. These entries are not editable.

8. The menu paths affected are:

Example on how the functionalities work:

Default currency: PLN

1. Create the following outstanding sales invoices with the different debtor GL in foreign currencies via menu path Finance/Entries/Sales

| Date |

Debtor |

Debtor GL Account |

Your Ref |

Currency |

Rate |

Amount FC |

Amount DC |

| 31.01.2007 |

Debtor 1 |

1300 |

123 |

USD |

1.2 |

100 |

120 |

| 31.01.2007 |

Debtor 1 |

1300 |

124 |

USD |

1.3 |

100 |

130 |

| 31.01.2007 |

Debtor 2 |

1300 |

500 |

USD |

1.1 |

200 |

220 |

| 31.01.2007 |

Debtor 2 |

1301 |

600 |

GBP |

2.3 |

300 |

690 |

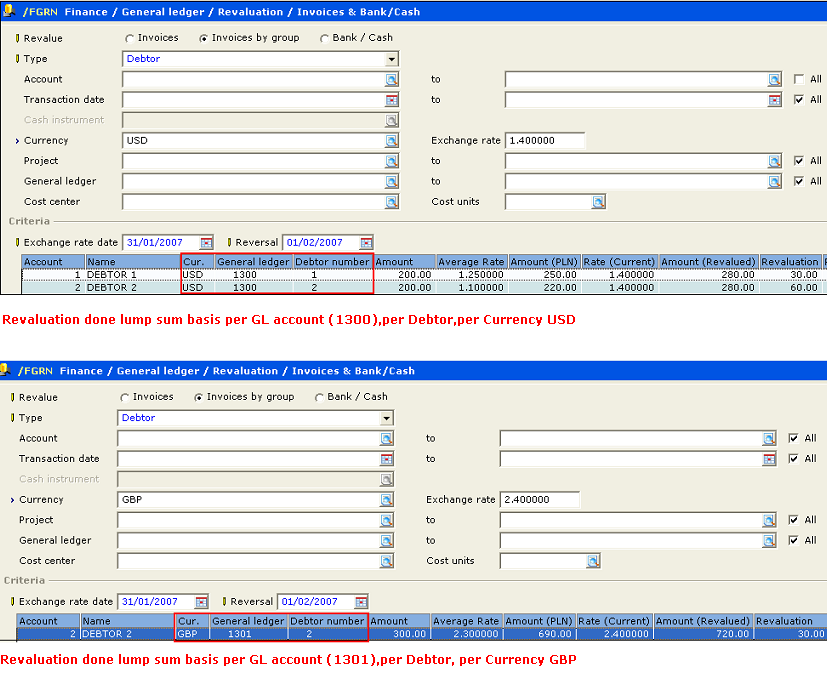

2. In menu path Finance/General Ledger/Revaluation/Invoices & Bank Cash, select option Invoice by group follows by selecting the entries. Then proceed with the process of revaluation by clicking the Revalue button and confirm the revaluation by clicking the OK button.

-

The Debtor General ledger is required to be revalued at the Rate of USD = 1.4, GBP = 2.4

-

The date of revaluation is 31.01.2006 (period 1)

-

The date of reverse of result of revaluation is 01.02.2006 (period 2)

The following screen displayed the entries to be evaluated.

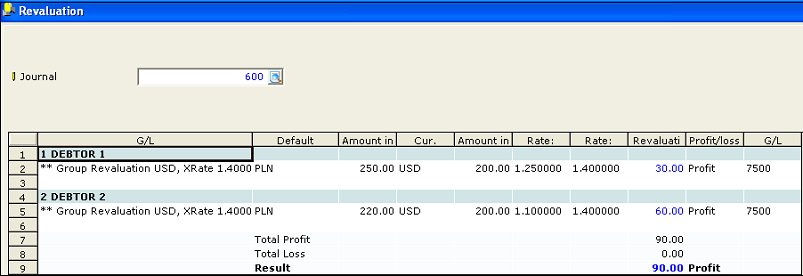

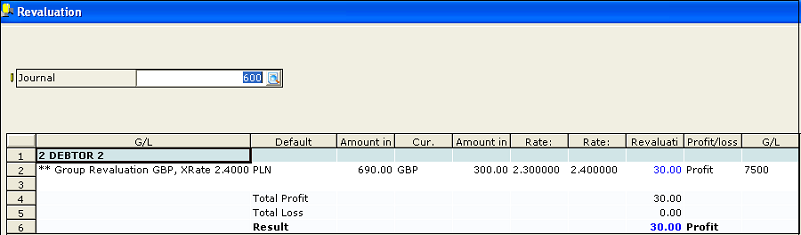

The following screen is displayed after clicking the Revalue button.

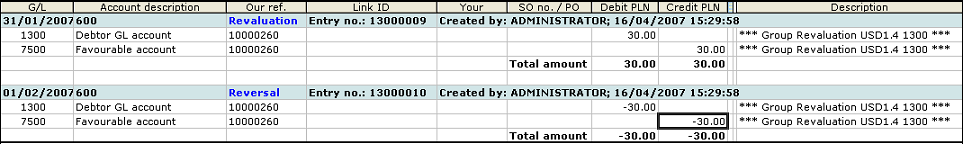

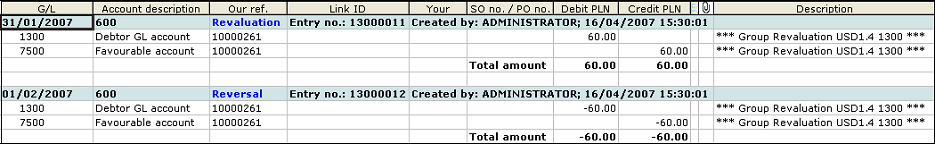

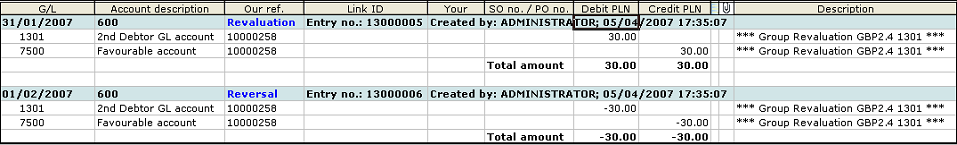

3. The following entries are expected to be generated via menu path Finance/Entries/General journal as a result of revaluation process.

Precondition and scope of the entries:

-

The Revaluation and Reversal entry will be created as different Entry number.

-

The reversal entry shall use the same Our ref as the revaluation entry.

-

These entries cannot be edited via general journal.

-

Description of these entries will be filled with same description with the following format.

**Group Revaluation (XXX/YYYYYY.YYYYYY/ZZZZZZZZZ)** where X = Currency, Y=Exchange rates, Z =GL code

Example : per Currency per Debtor or Creditor per GL per Project per CC per CU.

(A) Cumulative Revaluation calculated for GL 1300, Debtor 1, currency USD on amount of 200 for rate of exchange 1.4

Reverse cumulative revaluation calculated for GL 1300, Debtor 1, currency USD on amount of 200 for rate of exchange 1.4

(B) Cumulative revaluation calculated for GL 1300, Debtor 2, currency USD on amount of 200 for rate of exchange 1.4

Reverse cumulative revaluation calculated for GL 1300, Debtor 2, currency USD on amount of 200 for rate of exchange 1.4

(C) Cumulative revaluation calculated for GL 1301, Debtor 2, currency GBP on amount of 300 for rate of exchange 2.4

Reverse cumulative revaluation calculated for GL 1301, Debtor 2, currency GBP on amount of 300 for rate of exchange 2.4

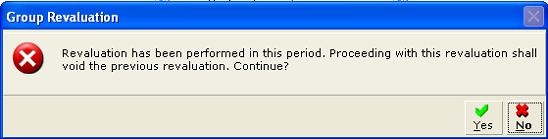

4. Revaluation is allowed once per period only and its reversal entries will be generated in the immediate next period. In case the user perform second revaluation on a period where the revaluation has been performed, a message will be prompted to alert the user.

Selection: Yes

System will set the old entries to VOID and the revaluation process RE-generated.

Selection: No

There will be no chances on the old entries created via general journal.

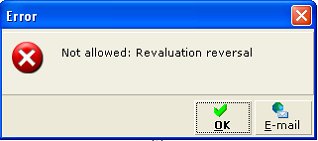

5. Matching application does not allow any un-matching of revaluation terms created. The system will prompt a message to alert the user.

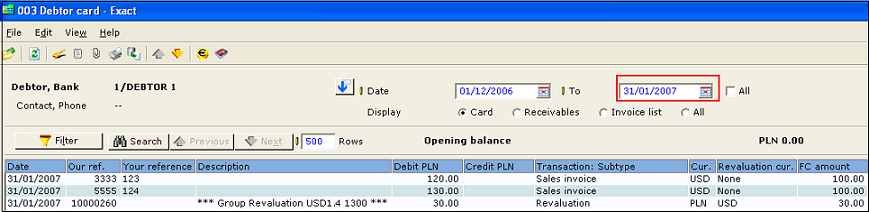

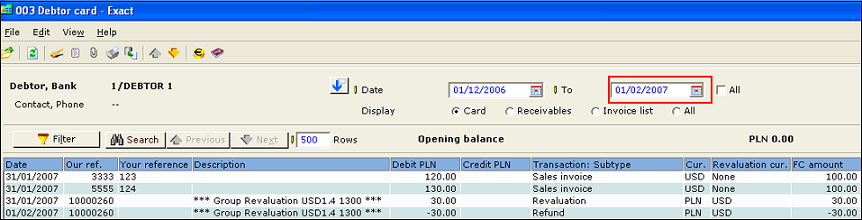

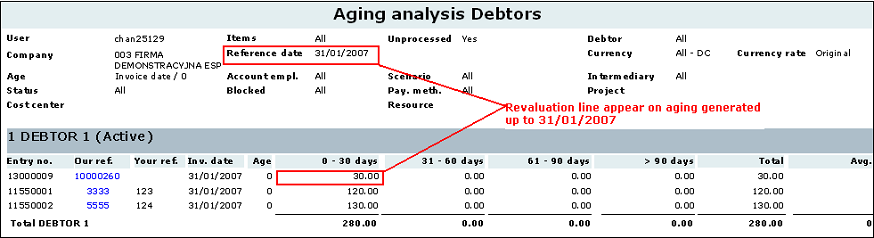

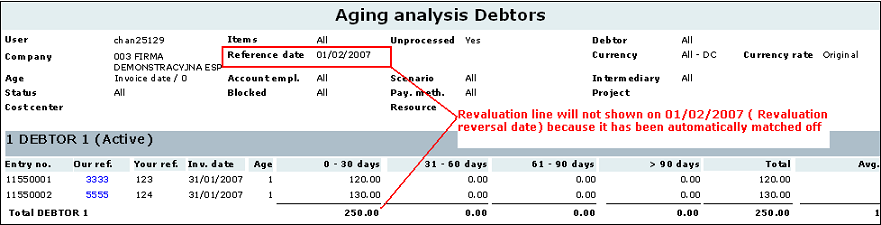

6. These new lines will appear in the Debtor cards, Creditor cards and GL cards and the Aging analysis report for debtor and creditor as follows:

(A) Debtors Cards view as at 31/01/2007

(B) Debtors card view on 1/2/07 (Revaluation reversal date)

(C) Aging analysis report as at 31/01/07

(D) Aging report on 1/2/07 (Revaluation reversal date)

7. Those entries created can be changed in the change function found in the Change button via the following menu path:

-

Finance/General Ledger/Select /Search

-

Finance/ General Ledger/Analytical accounting

-

Journal entries

-

GL cards, Debtor Cards and Creditor cards

-

Screens displayed with the Our ref button

In the Change screen, the following fields are not editable:

-

General Ledger Account

-

Debtor /Creditor

-

Payment reference

-

Transtype

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

15.596.894 |

| Assortment: |

Exact Globe

|

Date: |

09-05-2017 |

| Release: |

380 |

Attachment: |

|

| Disclaimer |